Credit card fraud. All must-known facts.

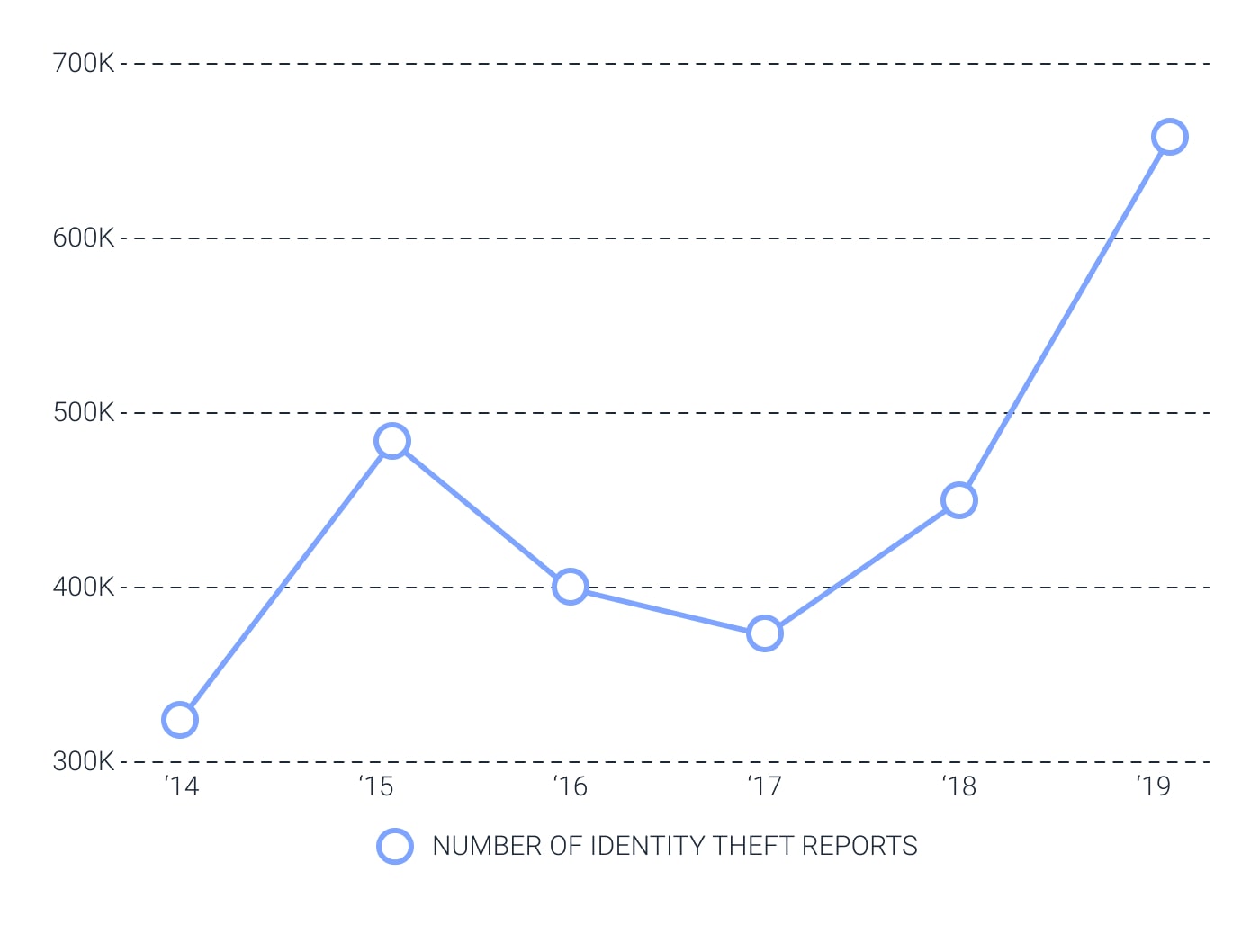

Identity theft is most commonly associated with credit card fraud. According to data for 2019, more than 650 thousand cases of identity theft were recorded in the United States. This figure is the highest since 2015.

Given the damage that identity theft and credit card fraud can cause to your life, many consumers want to know how realistic these incidents can be prevented.

Types of credit card fraud

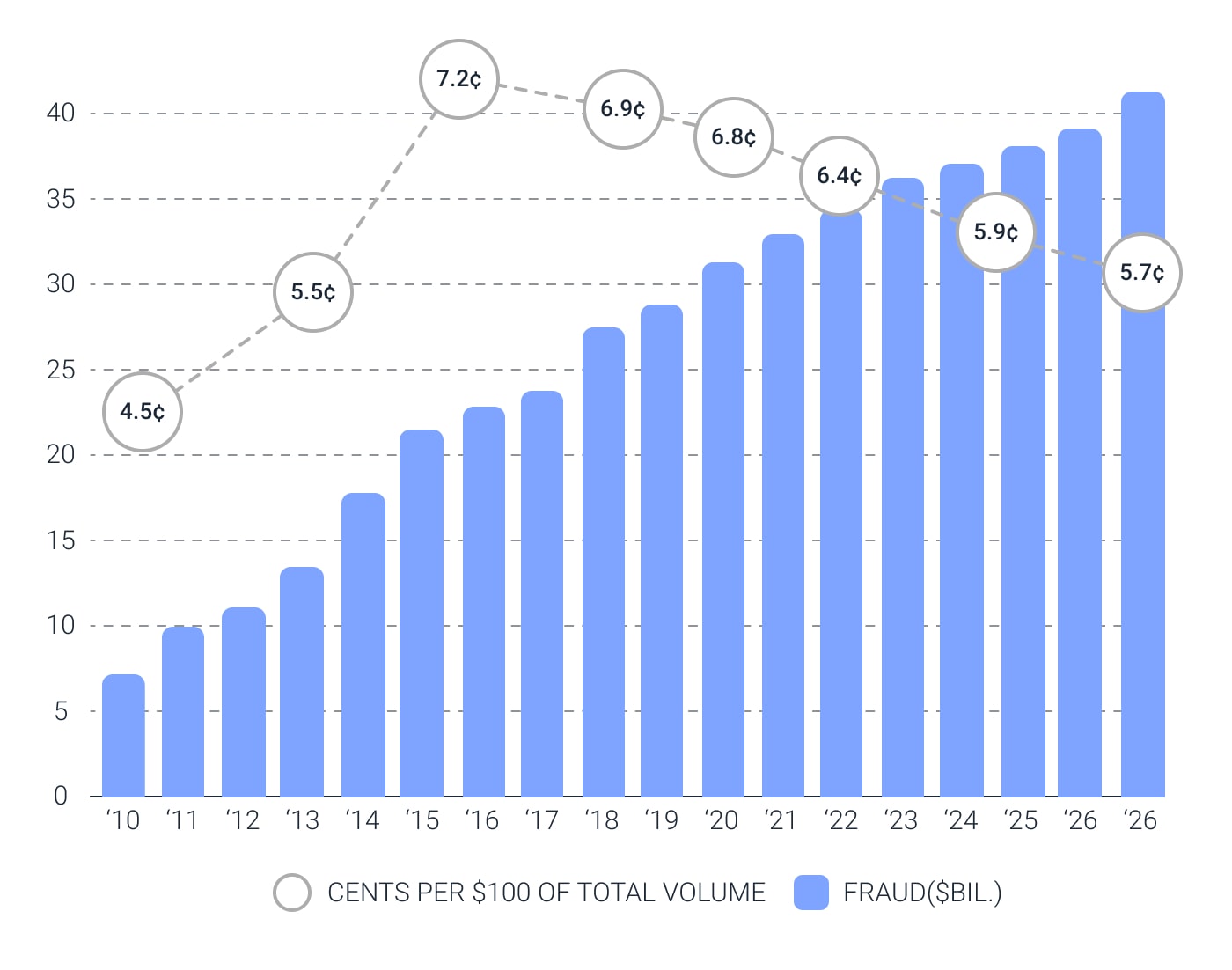

Credit card fraud is taking its toll on the global economy. Based on the statistics, losses in 2020 amount to more than $ 35 billion and continue to grow.

To prevent such incidents, each network user should familiarize himself with the typical theft of payment data and how to avoid it.

- Bank card theft. The user forgot the card on the store counter, the wallet fell out, or the attacker purposefully stole the card. The best solution is to call the bank and ask to block the card as soon as you notice the loss;

- Gaining access to a bank account. Fraudsters can use the client’s data to gain access to funds. Such data may include telephone number, home address, mother’s maiden name. Thus, scammers try to report the loss of the card and get a new one;

- Skimming. Skimming is the theft of data using special readers. All data stored on the magnetic stripe of the card are stolen: number, CVV-code, username, card expiration date. Special overlays on the ATM panel allow you to find out the PIN code. After the fraudster has found out all the data, he can create a duplicate card;

- Interception of cards. Some banks send cards to users by mail.

How to identify fraudulent activities?

Preventive measures are the most effective method in the fight against fraudsters. Regularly review your payment history to identify unauthorized transfers of funds. Many banks, when opening a card, offer additional services to ensure the security of cards. Such services notify the cardholder of any suspicious activity or if, for example, your card data appears in the public domain.

Impact on business

Scammers can cheat merchants in a variety of ways, both online and in a retail store. They either sell the stolen data on the black market or use it to buy goods and services. When the real owner of the card notices that funds have been debited from the account without his knowledge, he tries to return these funds. One of the methods is chargeback. The procedure involves a refund by contacting the bank. This phenomenon negatively affects the credit history of the merchant and may lead to its blocking by the bank. Therefore, certain technologies can identify and prevent fraudulent credit card transactions:

Implement 3-D secure technology

Authentication with MasterCard SecureCode or Verified by Visa is an additional layer of protection for online transactions. To confirm the transaction, the user receives a one-time password with which he confirms the transaction. By implementing this technology, you can protect your business from chargebacks. New security protocol 3D Secure 2.0 allows you to authorize transactions using biometric data. Address verification of users This check boils down to comparing the user’s billing address with the data stored in the issuing bank.

Device identification

The system analyzes the device model, operating system, browser. All devices have unique identifiers similar to fingerprints, which allows the identification of suspicious transactions. Blacklists In the payment processing industry, blacklisting is one of the methods to combat fraud. The system identifies untrusted clients based on several filters, each of which verifies the authenticity of the transaction. After that, the data is compared with the information stored in the blacklist. If the match is positive, the transaction is rejected.

Flag large transactions

After taking possession of bank data, fraudsters seek to withdraw all funds as quickly as possible. To do this, they make transfers of large amounts. Merchants, like users, can limit large transactions by specifying a maximum transaction amount to avoid chargebacks.

The bottom line

The problem of fraud with bank cards is indeed quite common. Of course, there are many fraudulent schemes, but there are also reliable fraud protection mechanisms that allow, if not completely prevent, then minimize the damage. To achieve maximum security of financial transactions, we recommend using only reliable payment service providers that provide only licensed software.

Sign up for the newsletter

Keep up-to-date with all things payments

By submitting this form, you acknowledge that you have reviewed the terms of our Privacy Policy and consent to the use of data in accordance therewith.

Thank you for subscribing to our newsletter